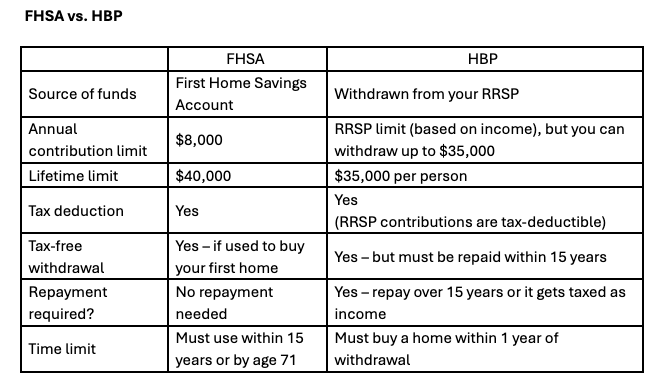

First Home Savings Account (FHSA) versus First Time Home Buyers' Plan (HBP)

Two Canadian savings programs designed to help first-time buyers save for a home, but with key differences.

*as of 2025

When to use the FHSA

The FHSA is ideal if you’re a first-time home buyer with time to save. It’s perfect if you want the benefit of tax-deductible contributions now, combined with tax-free growth and withdrawals, without the need to repay the funds later. This account is especially useful if you haven’t yet maxed out your FHSA contribution room of $40,000.

When to use the HBP

The HBP works well if you already have money saved in an RRSP and need access to more than $40,000 for your home purchase. It’s a good option when you want to combine savings tools but are comfortable with the requirement to repay the withdrawn amount over 15 years to avoid taxation.

FAQs

Can I use both the FHSA and HBP together?

Yes! If you're eligible, you can combine both programs to maximize your down payment. That means accessing up to $40,000 from your FHSA and $35,000 from your RRSP via the HBP.

What happens if I open an FHSA but don’t end up buying a home?

If you don’t use your FHSA to buy a home within 15 years (or by age 71), you can transfer the funds to your RRSP or RRIF tax-free, without affecting your RRSP contribution room. Otherwise, withdrawals are taxed as income.

What if my spouse or partner isn’t a first-time home buyer, can I still use these programs?

Yes. As long as you personally meet the “first-time home buyer” criteria, you can use the FHSA and/or HBP even if your spouse has previously owned a home or used one of these programs.

Do I have to repay money withdrawn from an FHSA like I do with the HBP?

No. FHSA withdrawals used to buy a qualifying home are permanent and tax-free. The HBP, however, requires you to repay 1/15th of the amount withdrawn each year, or else it’s taxed as income.

Can I use my RRSP contributions toward both the HBP and my retirement savings?

Yes, but when you withdraw money through the HBP, it must be repaid over time to maintain your retirement savings and avoid tax consequences. HBP withdrawals don’t reduce your RRSP contribution room upon withdrawal, but you do need to pay the money back to your RRSP.

I’m self-employed, which program is better for me?

The FHSA may be more flexible if your income varies from year to year. Since FHSA contributions have a flat annual limit and don’t depend on earned income, it’s often a good option for self-employed buyers.

What happens if I open an FHSA but don’t end up buying a home?

If you don’t use your FHSA to buy a home within 15 years (or by age 71), you can transfer the funds to your RRSP or RRIF tax-free, without affecting your RRSP contribution room. Otherwise, withdrawals are taxed as income.

Ready to take the next step?

Navigating these options can feel complex, but you don’t have to do it alone. We are here to help analyze your full financial picture, understand your priorities, and design a savings strategy that balances your short and long-term goals.

Reach out anytime to discuss your home ownership plans and how to make the most of these programs.

TL;DR:

FHSA vs. HBP: What’s the difference?

The First Home Savings Account (FHSA) and the Home Buyers’ Plan (HBP) both help first-time buyers save for a home, but they work differently.

FHSA lets you contribute up to $8,000 per year (to a $40,000 lifetime limit), with tax-deductible contributions and tax-free withdrawals — no repayment required.

HBP allows you to withdraw up to $35,000 from your RRSP tax-free, but you must repay it over 15 years.

You can combine both programs to access up to $75,000 toward your first home.

When to use each

Use the FHSA if you have time to save and want tax benefits without repayment.

Use the HBP if you already have RRSP savings and need additional funds.

We invite you to subscribe to our monthly newsletter and follow us on social media to stay connected and never miss an update.