Lifelong Learning Plan (LLP)

The Lifelong Learning Plan (LLP) is a program offered by the Canada Revenue Agency (CRA) that allows individuals to withdraw funds from their Registered Retirement Savings Plan (RRSP) to finance full-time education or training for themselves or their spouse/common-law partner without being taxed at the time of withdrawal.

Designed to support career advancement and retraining, the LLP provides Canadians with a flexible way to enhance their skills, change careers, or pursue advanced studies—while easing the financial burden of tuition and related costs.

Key features

Withdraw up to $10,000 per year, to a maximum of $20,000 total per person under the plan.

Withdrawals are not taxed if LLP conditions are met.

Either the RRSP holder or their spouse/common-law partner may be eligible.

Repayment begins within 5 years after the first withdrawal and must be fully repaid within 10 years.

The program must be a qualifying educational program at a designated educational institution.

You may be required to provide proof of enrollment (e.g., a letter or receipt from the institution) if requested by the CRA.

If the student drops out or fails to meet LLP conditions, the withdrawal may become taxable.

Eligibility requirements

To participate in the LLP, the individual must:

Be a Canadian resident.

Be enrolled full-time in a qualifying educational program or have a spouse/common-law partner who is.

Withdraw only from their own RRSP, not from a spousal RRSP.

Submit the required forms to the institution that administers the RRSP.

Repayment terms

Repayments begin in the fifth year following the first LLP withdrawal.

At least 1/10th of the total amount withdrawn must be repaid annually.

If the minimum repayment is not made in any given year, the unpaid portion is added to the individual’s taxable income.

Generate stable retirement income

The program must be offered by a designated educational institution in Canada or abroad. These typically include:

Universities.

Colleges.

CEGEPs (in Quebec).

Trade schools.

Other certified post-secondary institutions.

Not eligible:

Programs shorter than 3 months.

Courses requiring fewer than 10 hours of weekly study.

Part-time programs, unless due to a disability.

Programs intended for children or other family members.

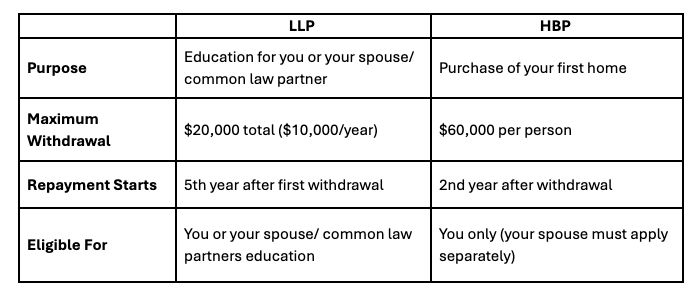

Lifelong Learning Plan (LLP) versus First-Time Home Buyers Plan (HBP)

LLP vs HBP plan

While both plans allow for tax-free RRSP withdrawals, they serve different life goals. Ensure you choose the one that aligns with your current needs.

The Lifelong Learning Plan encourages lifelong education and professional development by offering a tax-efficient way to finance full-time studies. However, using RRSP funds for education requires careful financial planning to balance immediate education costs with long-term retirement goals. We’re here to guide you through every step of the LLP process. Reach out today to discuss your plans and how this program can help you reach your goals.

For more information, visit the CRA’s official LLP page: Lifelong Learning Plan (CRA)

TL;DR:

The LLP lets you withdraw up to $20,000 total ($10,000/year) from your RRSP to fund full-time education or training for yourself or your spouse/common-law partner without immediate tax consequences.

Key points:

You must repay the amount over 10 years, starting in the 5th year.

Program must be at least 3 months long, with 10+ hours/week of coursework.

Only your own RRSP can be used.

If conditions aren’t met, the withdrawal becomes taxable income.

It’s a helpful tool for career changes or skill upgrades, but it’s important to weigh the impact on your retirement savings.

We invite you to subscribe to our monthly newsletter and follow us on social media to stay connected and never miss an update.